How Can a Jasmine Grand Mall Shop Deliver Strong Returns in 2026?

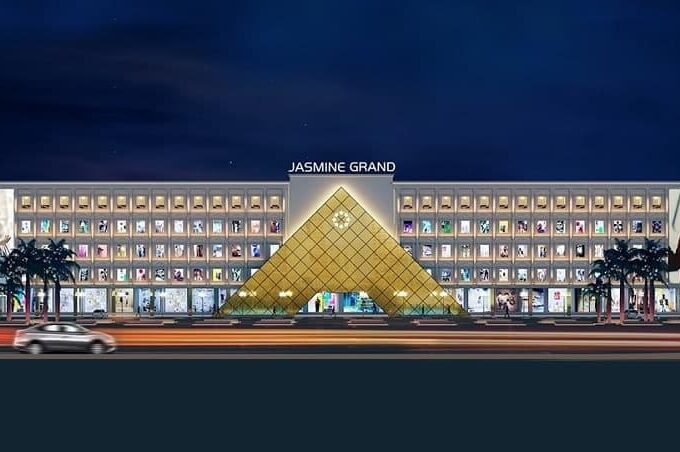

As commercial real estate in Lahore matures, investors in 2026 are shifting away from speculative buying toward income-driven, strategically located assets. Among the most talked-about opportunities is owning a shop in Jasmine Grand Mall, Bahria Town Lahore a development that blends modern retail planning with one of the city’s most secure and populated communities.

Jasmine Grand Mall Bahria Town Lahore Shop for Sale opportunities are attracting serious attention in 2026 as investors shift toward stable, income-generating commercial assets. For investors seeking predictable income, capital appreciation, and business sustainability, understanding how a Jasmine Grand Mall shop delivers strong returns in 2026 requires a closer look at market dynamics, location strength, and evolving consumer behavior.

At Property Finders, we evaluate commercial projects based on long-term viability rather than short-term hype. Jasmine Grand Mall stands out not merely as a retail space, but as a structured commercial ecosystem designed to support consistent footfall and rental demand well into the future.

Strategic Location Advantage in Bahria Town Lahore

Location remains the single most powerful driver of commercial performance. Bahria Town Lahore continues to function as a self-sustained urban hub, with controlled entry points, dense residential zones, and a population that prefers localized retail experiences. Jasmine Grand Mall benefits directly from this ecosystem, drawing daily traffic from residents, office workers, and visitors.

In 2026, when fuel costs and time efficiency influence shopping habits, malls embedded within residential master communities outperform standalone commercial plazas. This locational resilience plays a key role in how a Jasmine Grand Mall shop delivers strong returns in 2026, as consistent footfall translates into stable rental demand and stronger tenant retention.

Planned Retail Mix and Brand Compatibility

Unlike unplanned commercial markets, Jasmine Grand Mall follows a curated retail strategy. The tenant mix is designed to balance daily-need outlets, branded stores, food chains, and service providers. This balance ensures that footfall is not seasonal or trend-dependent but remains consistent throughout the year.

For shop owners, this translates into reduced vacancy risk and higher lease stability. In 2026, retailers are increasingly selective about location quality, favoring malls where complementary brands drive shared traffic. Property Finders considers this structured retail planning a major contributor to sustainable commercial performance.

Rental Yield Stability in a Changing Economy

Economic uncertainty has made investors prioritize assets that generate predictable income. Commercial shops in well-managed malls offer a hedge against inflation, particularly when rental agreements are indexed to market adjustments. Jasmine Grand Mall’s positioning within Bahria Town supports premium rentals relative to surrounding commercial areas.

For investors evaluating how a Jasmine Grand Mall shop delivers strong returns in 2026, rental yield stability is a defining factor. The demand from retailers seeking exposure to Bahria Town’s affluent demographic keeps rental values competitive, even during broader market slowdowns.

Capital Appreciation Through Controlled Development

Capital appreciation in commercial real estate depends heavily on supply control. Bahria Town’s regulated planning limits random commercial expansion, preserving the value of existing retail hubs. Jasmine Grand Mall benefits from this controlled development approach, which restricts oversupply and protects long-term asset value.

In 2026, when overdevelopment has diluted returns in many urban centers, such supply discipline becomes a decisive advantage. Property Finders advises investors to consider not just current income, but how zoning and future approvals impact resale value over time.

Investor-Friendly Ownership and Leasing Dynamics

Another factor influencing strong returns is ease of ownership and leasing. Shops in Jasmine Grand Mall are designed with practical layouts, standardized sizes, and modern infrastructure features that simplify leasing and reduce tenant fit-out costs.

This flexibility attracts a wider tenant pool, from franchise operators to independent retailers. As a result, shop owners experience shorter vacancy cycles, reinforcing how a Jasmine Grand Mall shop delivers strong returns in 2026 through uninterrupted income streams.

Consumer Behavior Trends Supporting Mall Retail

Despite the rise of e-commerce, physical retail remains dominant in lifestyle-oriented communities like Bahria Town. In 2026, experiential shopping dining, leisure, and branded retail continues to drive mall footfall. Jasmine Grand Mall aligns with this trend by offering an environment where shopping is combined with social engagement.

For investors, this behavioral shift is critical. Shops that cater to experience-driven consumption are less vulnerable to online competition, ensuring relevance and profitability over the long term.

Payment Flexibility and Entry Timing

Although returns are realized over time, entry strategy matters. Flexible installment options and phased payment structures allow investors to preserve liquidity while securing premium commercial assets. Early entry into projects like Jasmine Grand Mall often results in better unit selection and stronger appreciation potential.

Property Finders encourages investors to align payment plans with revenue timelines, particularly when leasing income can offset installment obligations. This financial alignment strengthens how a Jasmine Grand Mall shop delivers strong returns in 2026 without excessive upfront pressure.

Long Term Demand from Business Owners

Retailers in 2026 are increasingly focused on visibility, security, and customer accessibility. Jasmine Grand Mall meets these requirements through centralized placement, professional management, and a controlled commercial environment.

This makes it a preferred destination for Long Term Business operations rather than short-term pop-ups.Sustained tenant demand directly supports rental continuity and resale attractiveness, reinforcing the investment case for shop ownership in this development.

Frequently Asked Questions (FAQs)

1. Is a Jasmine Grand Mall shop suitable for long-term investment in 2026?

Yes, its location, planned retail mix, and controlled development environment make it suitable for long-term income and value growth.

2. Can investors expect consistent rental demand in Jasmine Grand Mall?

Consistent footfall from Bahria Town residents and brand-driven retail demand support stable leasing activity.

3. How does Bahria Town Lahore influence shop performance?

Bahria Town’s dense population, security, and lifestyle infrastructure significantly enhance commercial footfall and spending capacity.

4. Are mall-based shops safer than standalone commercial units?

Generally, yes. Mall management, tenant mix planning, and shared footfall reduce vacancy risk compared to isolated shops.

5. Why does Property Finders recommend Jasmine Grand Mall for 2026 investors?

Because it combines income stability, controlled appreciation, and strong end-user demand within one of Lahore’s most reliable communities.

![Epoxy Curing Agents Market Growth Analysis Report | Industry Status, Market Opportunities, Key Challenges, Competitive Strategies, Revenue Breakdown, and Forecast Outlook [2025–2034]](https://driftelano.com/wp-content/uploads/2025/12/Epoxy-Curing-Agents-Market.jpg)

![EMI Shielding Market Insights and Analysis [2025–2034] | Industry Performance, Growth Opportunities, Risk Factors, Strategic Developments, and Long-Term Market Projections](https://driftelano.com/wp-content/uploads/2025/12/EMI-Shielding-Market.jpg)

![Dimethyl Ether (DME) Market [Latest Reports] | Business Environment Analysis, Corporate Strategies, Competitive Benchmarking, Investment Trends, and Emerging Market Developments [2025–2034]](https://driftelano.com/wp-content/uploads/2025/12/Dimethyl-Ether-DME-Market.png)

Leave a Reply